In short:

· Russia invades Ukraine, introducing more uncertainty to markets

· Fourth quarter ‘21 earnings are strong, but momentum is fading

In what came as a shock to many, Russia launched a full-scale invasion of Ukraine this month. Markets had mispriced this eventuality, as the irrationality and unpredictability of Putin’s actions were difficult to anticipate. Putin has justified his operations as the “demilitarisation” and “denazification” of Ukraine. This implies that he intends to force complete change of government or at least ensure that Ukraine refrains from opposing Russia’s foreign policy rules.

As we approach the end of the first full week of conflict, whilst taking control of significant landmass, Russia has been unable to achieve their initial objectives. Putin seems to have underestimated the resolve of the Ukrainian forces and their ability to disrupt Russian forward logistics. Putin’s actions have been almost unanimously condemned and he is facing increasing international isolation. Longstanding foreign policy stances in Europe, in countries like Germany and Sweden have been altered – reflecting the geopolitical impact of recent weeks.

Sanctions have been coordinated and more severe than many anticipated. Sanctions targeted key institutions of the economy, as well as the Central Bank of Russia (CRB), albeit with important exemptions for Russia’s oil and gas exports. Sanctions on the CRB are unprecedented for an economy of this size. With half of the CRB’s foreign exchange reserves effectively frozen, the bank’s ability to effectively manage its exchange rate and foreign payments is now severely compromised. It’s inability to use USD will trigger defaults on external debt. Capital controls have been introduced. All of this has detrimental effects on the Russian economy.

Given Putin’s rhetoric, it appears unlikely that sanctions will alter his behaviour. But it is no doubt hoped that the damage to Russia’s economy will weaken his hold on power. Such a change cannot be expected within a short period of time. In the shorter term, one could expect more erratic behaviour from the Kremlin. For example, Russia could retaliate by restricting gas supplies to Europe. This is a tactic that was not used, even at the height of the Cold War, but is conceivable if Putin is feeling increasingly cornered.

The balance of risks for the economic outlook is now skewed entirely in the direction of slower growth and higher inflation. What seems certain is a larger hit on European GDP growth than what was initially expected. Higher energy prices will undoubtably keep inflation elevated, which will complicate the task of monetary policy in both Europe and the US. It’s unlikely that central banks will look to tighten conditions with the same determination given the uncertain outlook.

Given the uncertain outlook in Europe, we prefer larger allocations to US equity as we expect US companies to be more sheltered from the effects of slower economic growth in Europe due to constrained energy supply. Within Europe, we prefer markets with larger exposure to energy companies, such as the FTSE100.

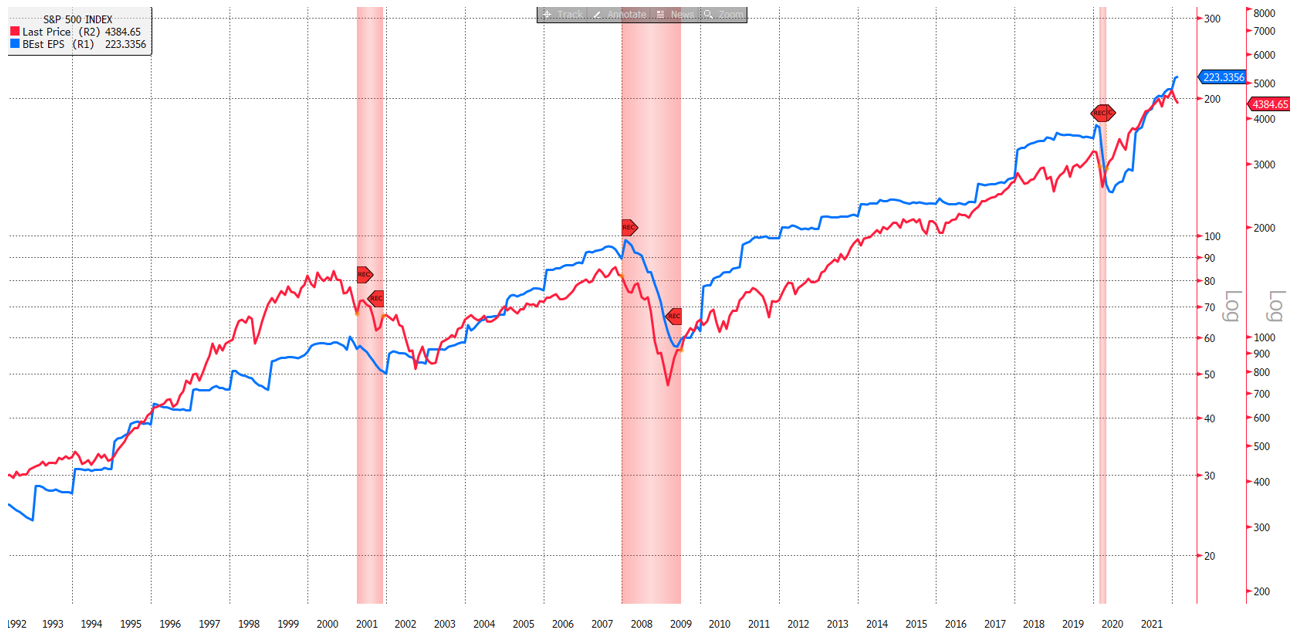

With most the S&P 500 having reported their fourth quarter ’21 earnings, let’s highlight some of the most important takeaways. Earnings per share grew by 30.25% when comparing to 4Q20. 76% of companies within the index reported earnings that beat analyst expectations, surprising positively by around 6%. Energy companies were a key driver of earnings growth in the index. Utility companies were the only sector that reported negative growth. On a sequential basis however, earnings growth slowed for the second quarter in a row. Top line revenue growth was 17.63% higher than 4Q20, with a marginally sequential growth than the previous quarter.

In Europe, the Stoxx600 reported stronger beats on both earnings and revenue, with the highest proportion of companies reporting higher revenue growth than expected since 2017. Fourth quarter earnings per share was 47% higher when comparing to 4Q20. When comparing to last quarter, earnings growth increased. Cyclical companies outperformed defensives from an earnings growth perspective.

Source: Bloomberg

Considering the strong quarter and company guidance, analysts have moved to upgrade their consensus for earnings for the quarters ahead. While fundamentals are strong, the market is currently selling off due in part to geopolitical uncertainty as well as expectations for tightening monetary conditions.

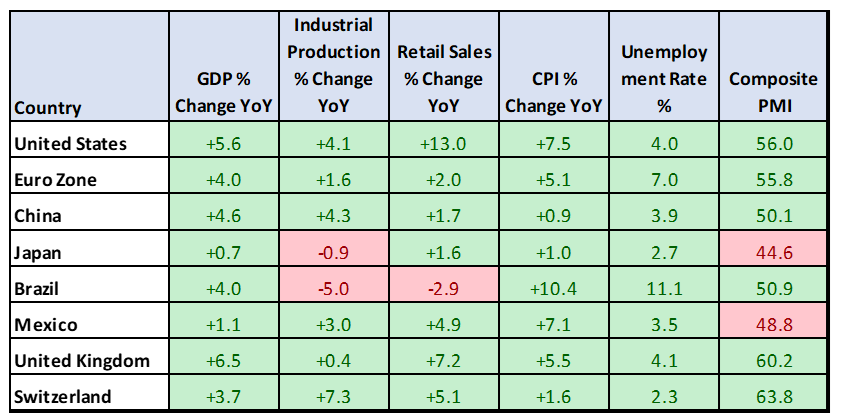

Global Economic Data Highlights

Source: Bloomberg

Disclaimer:

Parkview Ltd (CRD 160171) and Parkview US LLC (160172) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC). Parkview Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered Office is 8 Shepherd Market, Suite 5, London W1J 7JY. Parkview Ltd is a member of VQF (member number 13043). The VQF Financial Services Standards Association is organized under the terms of Art. 60 et seq. of the Swiss Civil Code (SCC) (established 1998), recorded in the Commercial Register of the Canton of Zug. VQF is the oldest and largest self-regulatory organization (SRO) pursuant to Art. 24 of the Anti-Money Laundering Act (AMLA) with the official recognition of the Federal Financial Market Supervisory Authority (FINMA). In addition, the VQF also has rules of professional conduct for asset managers which are officially recognized by FINMA and in this regard is active as an Industry Organization for independent Asset Managers (BOVV).