In short:

· A tough start to 2022 for equities, as real yields rise

· In most other markets, things are calmer

· The Fed outlines the process of tightening policy in 2022

What started as a sell-off in high-flying innovation stocks has evolved into a broad market drawdown in global equities this month. 2022 has started out poorly for equity investors, with the S&P 500 down -8.7% at the time of writing. High beta small caps and tech names have fared worse, with the Russell 2000 and Nasdaq down -12% and 13.4% respectively.

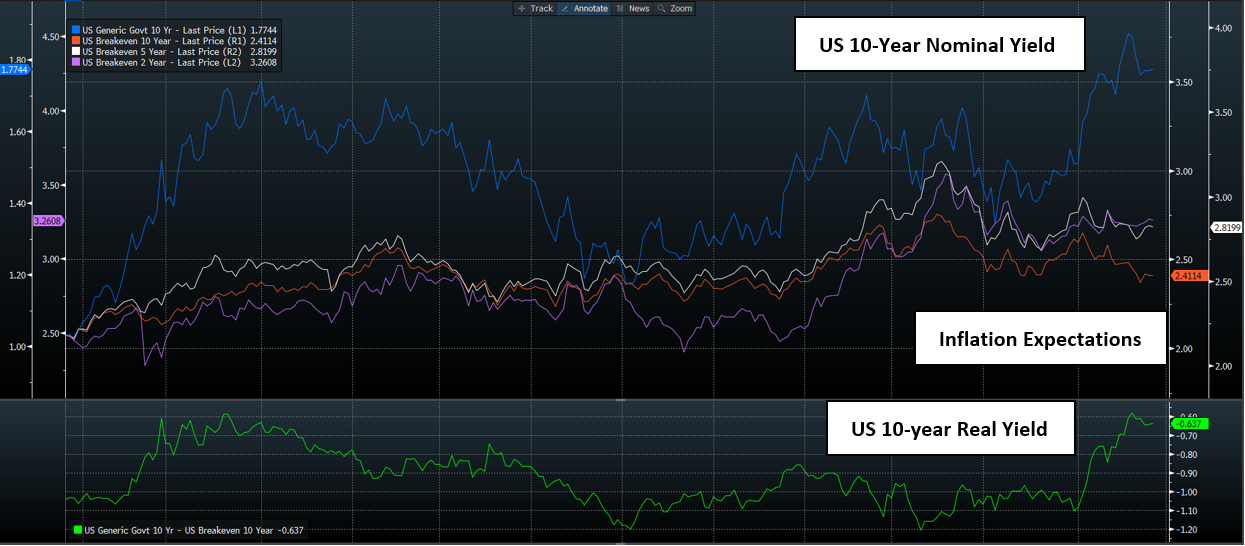

Cyclical stocks have outperformed growth, as the sector rotation continues. Much of this move can be attributed to recent moves in the bond market. Yields on US 10-year Treasury bonds have increased from 1.5% to around 1.8% since the beginning of the year, as investors have factored in expectations for higher short-term rates and a generally less certain path for longer-term yields. Higher treasury yields are generally harmful to companies that derive most of their value from their earnings expected far out into the future. Higher yields usually mean higher discount rates applied to these earnings, and therefore lower valuations. Companies that are still in high-growth mode tend to fall into this category – many of which performed strongly since the Covid selloff. The most expensive stocks require confidence in the future growth outlook to justify their valuation, as well as a healthy liquidity environment.

Source: Bloomberg

Despite high realised inflation over the past 6 months, inflation expectations have yet to become unanchored. In fact, since the beginning of 2022, we have seen long term inflation expectations ease from 2.6% to around 2.4%. The move in nominal bond yields is purely due to an abrupt increase in real yields. Statistically, the 40bp move in real yields that we have seen since the beginning of 2022 is one of the largest bi-weekly moves over the last 10 years. When taking into context, it is not surprising that interest rate sensitive assets have sold off materially this month

Outside of equity markets, things are much calmer for now. Credit spreads, although wider than pre-covid levels, are not signalling any broad distress. The Dollar and Yen have also yet to show a meaningful rally that would imply investors are in flight to safety mode. Within equities, dip buying remains robust. Volatility on the S&P 500, shown by the VIX, seems to have recently peaked above 30. We have also seen limited outflows from large funds, despite the recent turmoil.

Source: Bloomberg

The Federal Reserve met this week and outlined their plans for normalisation of monetary policy. They are already underway with tapering their bond purchases, which are expected to be halted by March. The market is now pricing in more than 4 rate hikes by the end of the year, and some economists are forecasting even more. In addition, they have signalled that they will begin shrinking their balance sheet by not reinvesting the proceeds of maturing treasury bonds that they hold. This process of “Quantitative Tightening” (QT) will eventually shrink the balance sheet of the Fed, eliminating bank reserves in the process.

When buying bonds during QE, the Fed rebalances the asset composition of the private sector away from credit and duration intensive bonds, into more zero-risk bank reserves. The private sector is then compelled to buy more risky assets to meet investment goals. This rebalancing effect is one of the key mechanisms that has underpinned risk asset performance in recent years. Under QT, the opposite can be expected. Without the marginal buyer of treasury bonds in the Fed, the private sector is called on to own more of the bonds that the treasury issues to fund the government. As holders of more duration-intensive bonds and fewer bank reserves/deposits, the private sector is less compelled to buy riskier assets to meet its goals. All else equal, QT could have a dampening effect on the risk appetite of banks and non- bank financial institutions in the years ahead.

In his January press conference, Chairman Powell did little to put investors at ease around fears of very hawkish policy changes this year. Despite signs of slowing economic growth, weak labour force participation and a flattening yield curve – Powell reiterated his hawkish stance. By not explicitly denying the potential of 50bp hikes throughout the cycle as well as leaving room for hikes every meeting this year, he has not removed the worst-case scenario that investors feared. The bond market responded by pricing in almost 5 policy rate hikes by the end of 2022.

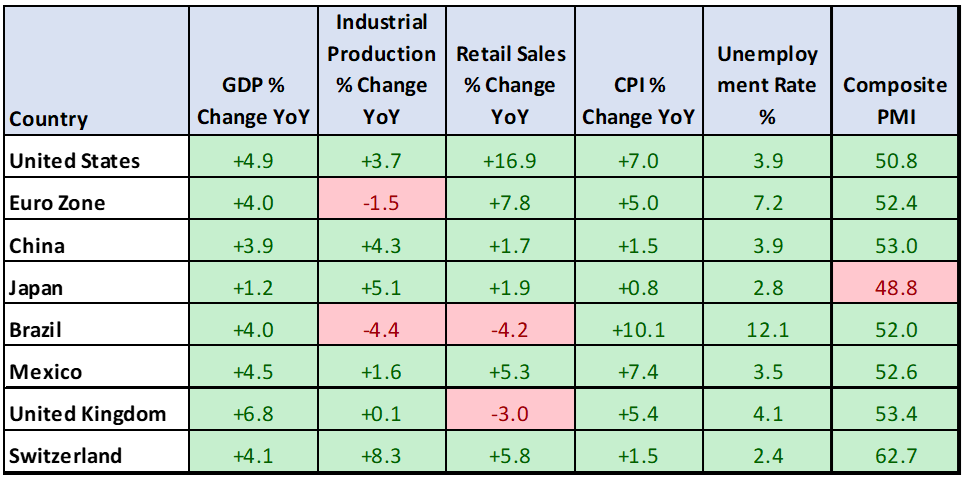

Global Economic Data Highlights

Source: Bloomberg

Disclaimer:

Parkview Ltd (CRD 160171) and Parkview US LLC (160172) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC). Parkview Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered Office is 8 Shepherd Market, Suite 5, London W1J 7JY. Parkview Ltd is a member of VQF (member number 13043). The VQF Financial Services Standards Association is organized under the terms of Art. 60 et seq. of the Swiss Civil Code (SCC) (established 1998), recorded in the Commercial Register of the Canton of Zug. VQF is the oldest and largest self-regulatory organization (SRO) pursuant to Art. 24 of the Anti-Money Laundering Act (AMLA) with the official recognition of the Federal Financial Market Supervisory Authority (FINMA). In addition, the VQF also has rules of professional conduct for asset managers which are officially recognized by FINMA and in this regard is active as an Industry Organization for independent Asset Managers (BOVV).