In short:

- A return to bond market uncertainty is hurting risk assets

- Recent changes in market conditions justify our cautious positioning

- We tactically increase duration in portfolios as yields rise

February was a frustrating month for many investors. Changes in the outlook for interest rates meant that everything that worked during January, did not work well in February.

Throughout 2022, investors had to continuously revise their expectations for where they felt the Fed would end its policy rate hiking cycle. Often, they fell short, leading to increased volatility in bond markets. By October, it became apparent that inflation had peaked in the US. Helped by rapidly falling energy prices, goods inflation was cooling at an unexpected rate. This improving outlook was quickly acknowledged by the Fed and ECB, who began guiding towards a slowdown in their rate hiking plans. This newfound clarity in the outlook for policy rates led to a much-needed decrease in bond volatility, and with it, a more favourable environment for risk assets.

But in February, a series of data points were released that have cast doubt on whether the Fed can afford to stop raising rates by July this year. The labour market is still red hot, with payrolls beating expectations and jobless claims remaining low. Inflation, as measured by the consumer price index and the personal consumption expenditure price index, came in higher than expected. In addition, we saw revisions to previous months data that pointed to a far less encouraging decrease in prices than what was first thought. Consumer spending is also still robust, with retail sales numbers far stronger than expected.

All of the above has contributed to a change in sentiment this month. Investors are no longer expecting a calm, linear path lower for inflation and interest rates. But rather anticipating a less predictable period where inflation may remain higher for longer. With a few extra hikes now priced in, bond yields have shifted up across the curve. This has hurt equity markets broadly, but growth and cyclical names have fared worse. In addition, relatively higher yields have attracted foreign interest in US fixed income, driving the dollar up. A stronger dollar usually has negative implications for emerging market equities.

We have been conservatively positioned since 2022, with high cash allocations across our portfolios. The rapid change in market conditions seen in February is a reminder as to why we maintain this cautious stance.

In line with our base-case, we expect inflation expectations to revert to their downward trend in place since last year, but that this decline will take place against the backdrop of rapidly decelerating economic activity. We view the current environment as indicative of a market that had become complacent and was forced to quickly reassess its outlook, as new data was released.

We therefore view the current set up as a good opportunity to increase duration in our portfolios. Taking advantage of this period of higher yields across the curve, we are adding long-duration US Treasury exposure to capitalise on the downward longer-term trend in yields that we expect later in the year

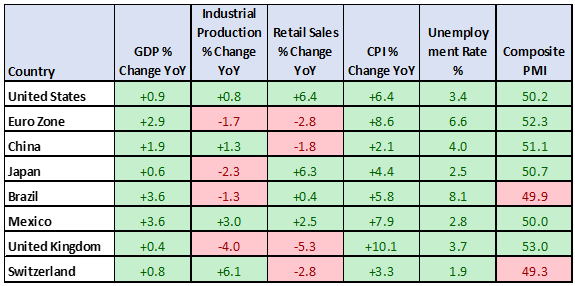

Global Economic Data Highlights

Source: Bloomberg

Global Risk Market Returns

Source: Bloomberg

Disclaimer:

Parkview Ltd (CRD 160171) and Parkview US LLC (160172) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC). Parkview Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered Office is 8 Shepherd Market, Suite 5, London W1J 7JY. Parkview Ltd is a member of VQF (member number 13043). The VQF Financial Services Standards Association is organized under the terms of Art. 60 et seq. of the Swiss Civil Code (SCC) (established 1998), recorded in the Commercial Register of the Canton of Zug. VQF is the oldest and largest self-regulatory organization (SRO) pursuant to Art. 24 of the Anti-Money Laundering Act (AMLA) with the official recognition of the Federal Financial Market Supervisory Authority (FINMA). In addition, the VQF also has rules of professional conduct for asset managers which are officially recognized by FINMA and in this regard is active as an Industry Organization for independent Asset Managers (BOVV).